There is a common trap that fashion brand founders fall into.

They spend months trying to shave 5%, 10%, or 15% off their customer acquisition cost. They optimize ad creatives. They tweak targeting. They chase every small win in the auction.

Here is the problem: paid advertising works on an auction model. There is a floor. You cannot go below a certain level because other brands are bidding against you for the same eyeballs. Once you hit that floor, you are stuck.

The Two Paths to Market Dominance

If you want to grow aggressively, you essentially have two choices:

→ Undercut everybody on price

→ Outspend everybody on acquisition

Here is the reality about undercutting on price: you often cannot win this game.

Think about Chinese sellers on Amazon. A basic pair of sneakers that normally retails for 80 euros? They can sell the same thing for 25 euros. You simply cannot compete with that.

Why? Because price competition depends on factors largely outside your control. Where you live. Labour costs. Taxes. Manufacturing infrastructure. Supply chain dynamics. In many cases, winning on price is not an option for you. That door is closed.

Outspending on acquisition is different. The ceiling is much, much higher. And that is the game you can actually win.

Why Outspending Wins

After having worked with over 100 fashion brands at Grapefox, here is what the numbers actually look like.

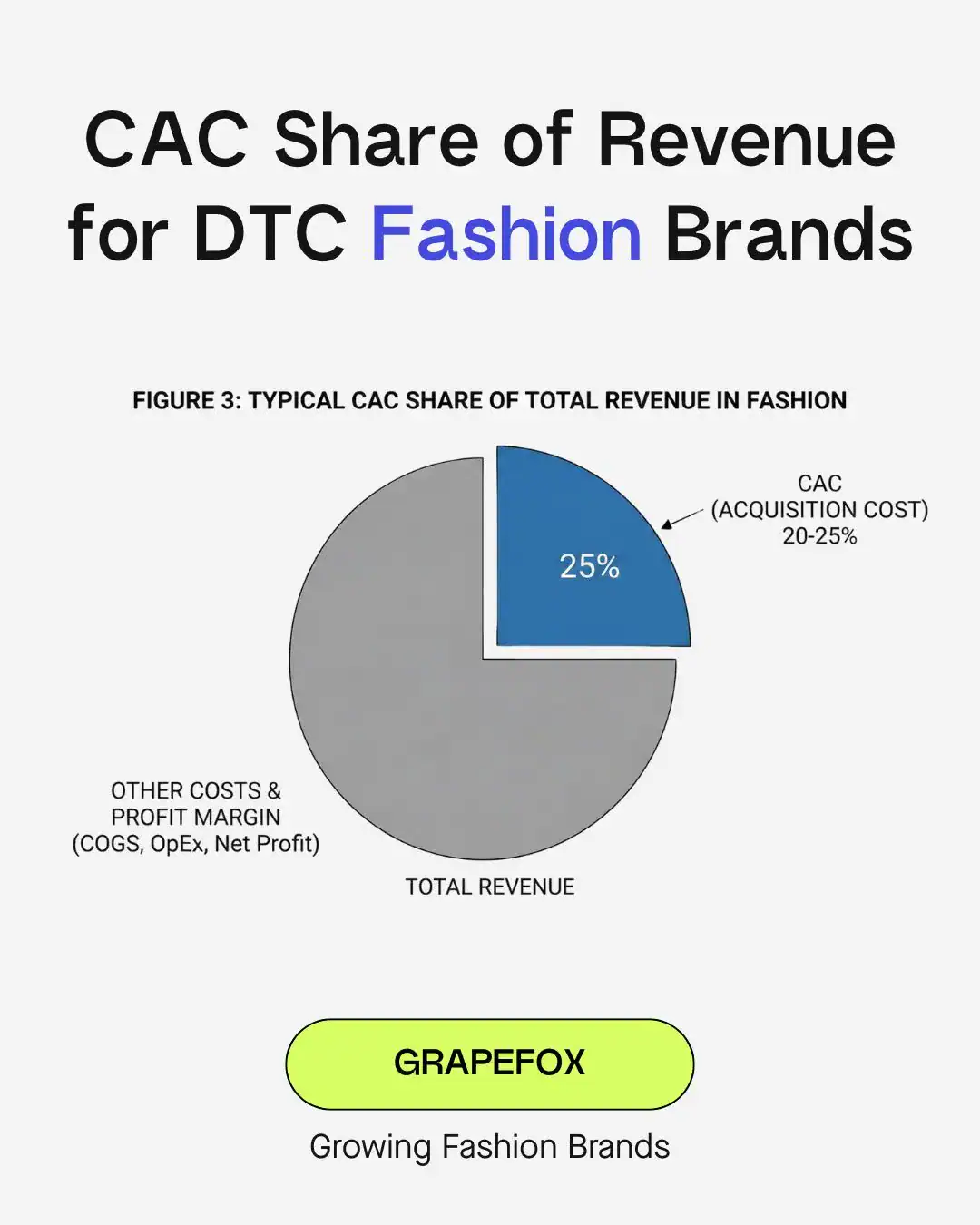

For pure direct-to-consumer fashion brands (online only, no physical stores), paid advertising typically represents 20-25% of revenue. If you sell a product for 200 euros, expect to spend around 40-50 euros to acquire that sale. This is the baseline.

Now, you might look at larger established fashion brands and see them spending only 8-9% on marketing.

Some people think: “See, they are more efficient.”

But that is misleading. Those brands have physical retail stores. What they are not spending on marketing, they are spending on fixed costs like rent, staff, and inventory for those locations. The total cost of acquisition remains similar; it is just distributed differently.

The 20-25% baseline is consistent across the industry. The question is not how to get that number lower. The question is how to make that spending work harder.

This comes down to unit economics.

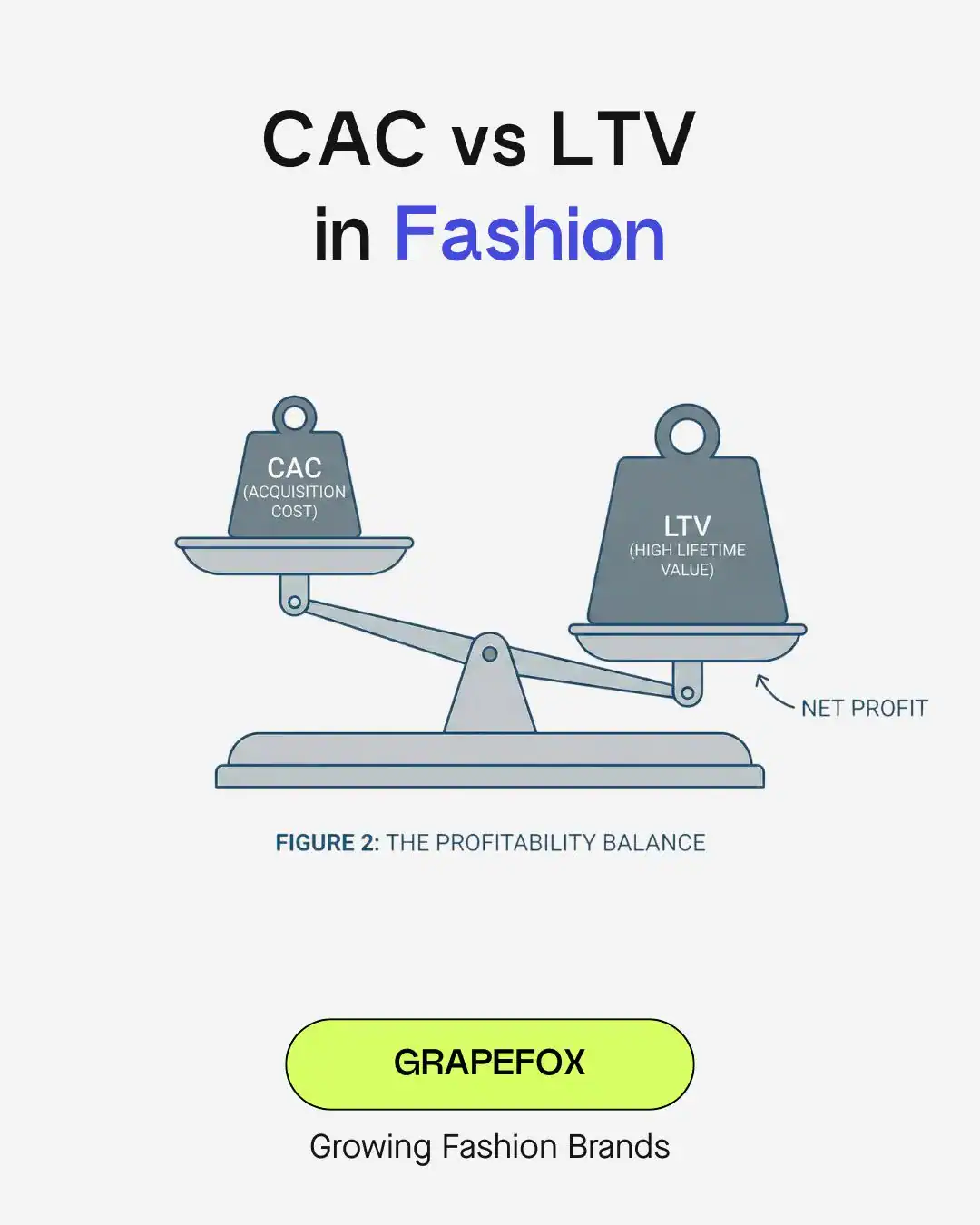

If you have better margins, you keep your operational costs lean, your cash flow is strong, and you have wholesale accounts generating revenue; your ceiling becomes significantly higher. You can bid 80 euros for a customer that is only worth 50 euros to your competitor. They cannot compete with you in the auction. You win.

The Personal Finance Analogy

Think about it like your personal finances.

If you do not have much money, you have two options. You can cut expenses aggressively; live with roommates, cook every meal, never go out. This works up to a point. But eventually, you have nothing left to cut. The next step is homelessness.

The smarter path is to increase your income. The ceiling on earning potential is far higher than the floor on cutting expenses. You could potentially make hundreds of thousands or millions per month. But you cannot cut your way to zero expenses.

The same principle applies to customer acquisition.

You can optimize your CAC down by maybe 15%. But you could potentially increase your ability to outspend competitors by 50% or more by improving your margins, operations, and revenue diversification. The upside is asymmetric.

Be Profitable on the First Sale

In fashion, you want to aim for profitability on the first purchase. Do not lose money acquiring a customer hoping they will come back.

Lifetime value calculations work well in software, where subscriptions create predictable recurring revenue. Fashion is different. You have seasonality. You have unpredictable buying patterns. A customer might love your summer collection and never return for winter. You cannot reliably predict lifetime value the way a SaaS company can.

If you lose money on the first sale betting on future purchases, you can do serious damage to your cash flow. The smarter approach is to break even or profit immediately. If you must lose money on acquisition, have backend offers that convert within 30 days. Otherwise, it becomes extremely difficult to manage.

What This Means in Practice

If your numbers are already “good enough,” stop obsessing over trimming a few more percentage points off your cost per acquisition.

Instead, focus on the things that raise your ceiling:

→ Improve your margins through better sourcing or pricing strategy

→ Sell to third-party retailers and wholesalers

This is critical. When a retailer buys from you, they often place substantial orders. A single wholesale account can generate 50,000 euros, pounds, or dollars per year. One customer. Recurring orders. When you close a retail account, that account keeps generating revenue consistently. Compare that to a single DTC sale where someone might repurchase in a few months (or might not).

→ Optimize your cash flow relentlessly

Fashion is a cash-intensive business. Inventory ties up capital. Seasonality creates uneven revenue. Strong cash flow management gives you the flexibility to invest in growth when opportunities appear.

→ Reduce operational costs and stay lean

If you sell only through your own ecommerce site and third-party retailers (no physical stores), aim to keep fixed costs under 10% of total revenue. Too many fashion brands burn money on overhead they do not need. The leaner you stay, the more you can allocate to growth.

If you do have physical stores, the equation shifts. Your fixed costs will be higher, but you need to spend less on marketing. What you are not paying for online impressions, you are paying for visibility on a street in a city. The store itself is a marketing channel; you are buying foot traffic instead of clicks. Either model can work, but you need to understand the trade-off.

→ Diversify revenue through multiple channels

→ Invest in organic traffic

The Bottom Line

Being obsessed with decreasing your cost per acquisition is a bit foolish in the long run. You are fighting over scraps at the floor instead of building toward a higher ceiling.

As long as your acquisition metrics are reasonably healthy, go.

Scale. Outspend. Win the auction.

The fashion brands that dominate markets are not the most efficient at cutting marketing and advertising costs. They are the ones who built the financial engine to outspend everyone else while staying profitable.