Nike just proved what most fashion brands refuse to admit: DTC-only is a growth trap.

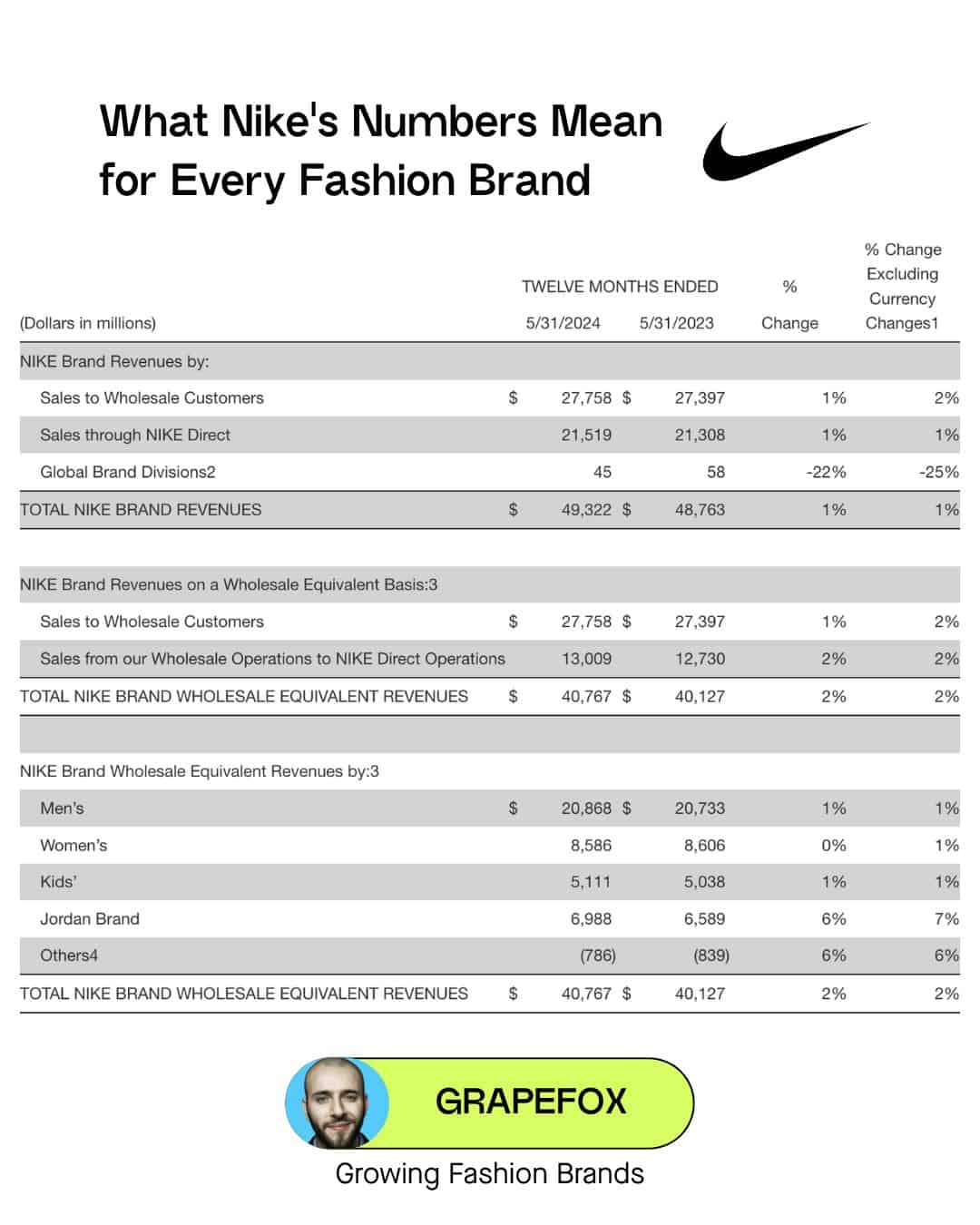

The sportswear giant’s latest financials reveal an uncomfortable truth: their revenue split is 56% wholesale, 44% direct-to-consumer.

And here’s the kicker: both channels grew at exactly the same rate over the past year.

Let that sink in.

The Great Wholesale Reversal

While everyone’s been preaching “wholesale is dead” and “go direct or go home,” Nike (a $49.3 billion company) is actively returning to wholesale partnerships after admitting they “went too far” pulling away from retailers.

In April 2024, CEO John Donahoe acknowledged this directly, stating that Nike had over-rotated away from wholesale in its push toward digital. The company cut ties with retailers like Macy’s, DSW, and Urban Outfitters in 2021. By late 2023, they were quietly rebuilding those exact relationships.

Why the reversal? Because DTC economics work against you after a certain point.

The Truth About DTC in Fashion

Yes, the margins look sexier. Yes, you control the narrative. But there’s a ceiling, and it’s lower than you think.

Customer acquisition costs have increased by 60% over the past five years. In 2022, 66% of DTC companies cited rising acquisition costs as their main obstacle to growth. Digital advertising costs continue to climb; Google’s average cost-per-click jumped 10% from 2023 to 2024 alone.

Nike’s data exposes the DTC-only fantasy:

↳ Wholesale revenues: $27.8 billion (up from $27.4 billion; 1% growth)

↳ DTC revenues: $21.5 billion (up from $21.3 billion; identical 1% growth)

↳ Wholesale equivalent: $40.8 billion (up from $40.1 billion; nearly double the DTC operation)

Why Wholesale Creates a Flywheel

Wholesale creates something DTC alone never can: omnipresence.

When customers see your brand at Nordstrom, Saks, and SSENSE, it doesn’t just drive wholesale revenue. It creates a flywheel effect that boosts your DTC sales through increased brand awareness. Retail partners bring established customer bases and geographic reach that would cost millions to replicate through digital advertising alone.

The math is simple:

Lower margins × massive reach = sustainable growth

Higher margins × limited reach = growth ceiling

Nike tried to maximize the DTC equation and hit a wall. Now they’re rebalancing with renewed partnerships at Macy’s and DSW.

The Segment Breakdown

↳ Men’s segment: $20.9 billion (dominated by wholesale reach)

↳ Women’s segment: $8.6 billion (flat growth, needing wholesale expansion)

↳ Jordan Brand: $7.0 billion (up 6%, thriving through retail partnerships)

Channel Harmony Is the Future

Stop viewing wholesale and DTC as competing channels. They’re complementary forces.

DTC gives you margin and customer relationships. Wholesale gives you reach and brand validation.

Anyone still claiming that retail is dying hasn’t looked at Nike’s numbers (or those of other highly successful fashion brands).

Sales to wholesale customers grew 2% on a currency-neutral basis, outpacing DTC growth. The company generated $13 billion in internal wholesale-to-DTC transfers, showing how wholesale operations fuel the entire ecosystem.

The most successful fashion brands of the next decade won’t be DTC-only purists. They’ll be the ones who master channel harmony.

The future isn’t direct-to-consumer. It’s direct-to-everywhere.