This fashion brand went from barely breaking even to a 12.8% net profit margin. Here’s exactly what we changed.

A French fashion brand came to us doing €45 million in annual revenue. About €10 million from e-commerce; the rest from wholesale and retail.

The e-commerce looked healthy on paper. Revenue was solid. Ads were running. Orders were coming in.

But every month, they were barely breaking even. Hovering around 1% operating margin.

The problem wasn’t sales. It was structure.

What the Audit Revealed

When we audited the business, here’s what we found:

↳ Too many hires that weren’t moving the needle

↳ Office space twice the size they needed

↳ Broken product feeds bleeding ad budget

↳ Poorly structured campaigns on Meta and Google

↳ No real-time visibility on profitability

↳ Monthly P&L reviews (by then it’s too late to adjust anything)

Classic scaling mistakes. They had grown the team and the costs, but not the efficiency.

This is more common than most founders realize. The average operating margin for clothing brands sits around 8.6%, but fashion e-commerce often operates on thin net margins of just 2% to 10%. Many brands look successful from the outside while quietly bleeding cash.

The Fix: Structure Before Scale

So we fixed it. Piece by piece.

On the fixed costs side:

↳ Cut non-essential roles

↳ Downsized the office

↳ Removed tools and subscriptions that weren’t delivering value

On the fixed costs side:

↳ Fixed every product feed error

↳ Restructured campaigns from scratch

↳ Cleaned up attribution gaps

The result: customer acquisition costs dropped nearly 10%. No extra budget; just fixing what was already broken.

The Real Game Changer: Visibility

But the real transformation came from visibility.

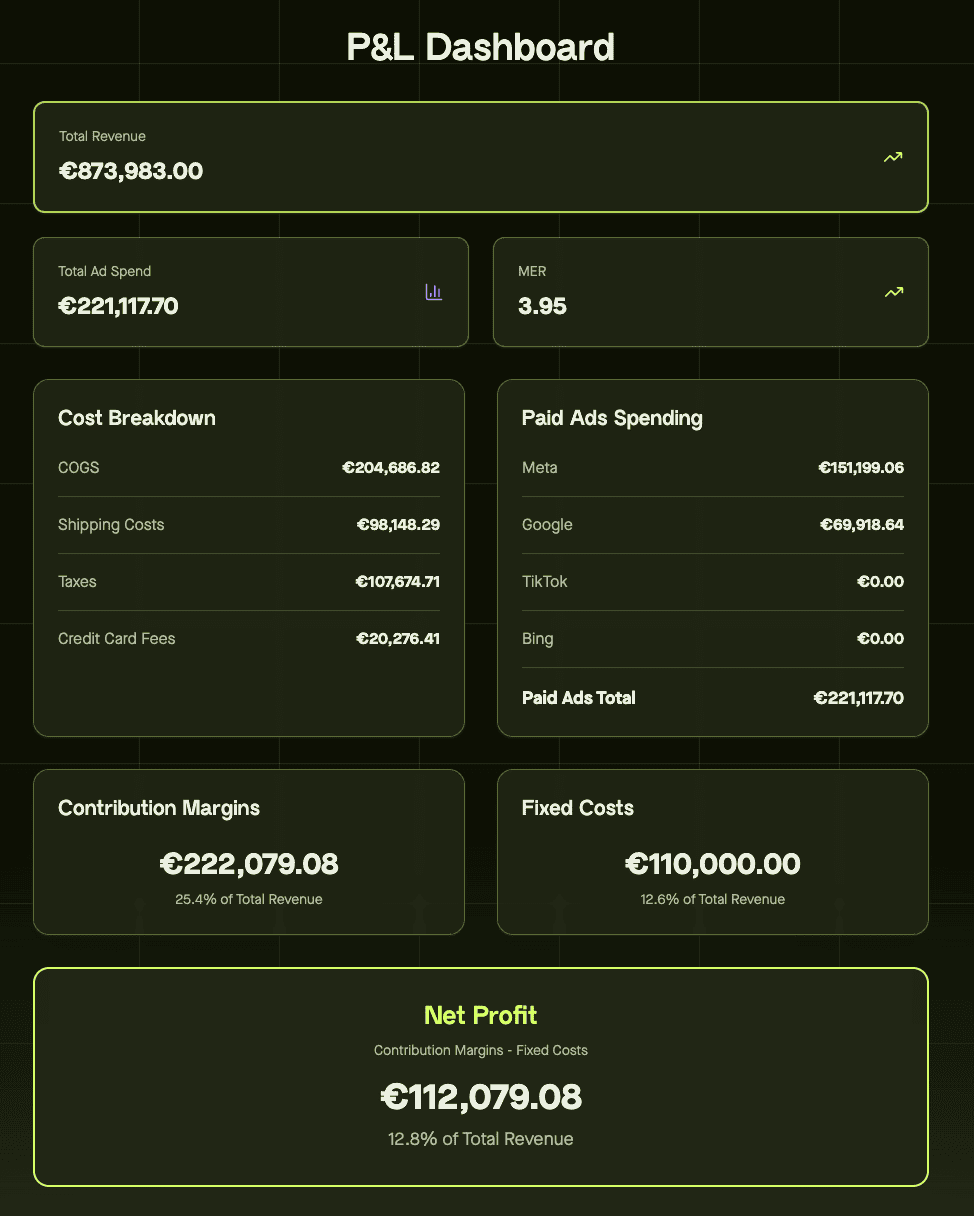

This brand spends around €220,000 per month on paid advertising. That’s roughly €7,000 every single day going out the door. At that scale, you simply cannot trust what the ad platforms tell you. The numbers in Meta and Google dashboards don’t account for your true costs: shipping, returns, payment fees, taxes, and everything else that eats into your actual margin.

We built daily P&L reports. Every morning, we knew exactly how much profit (or loss) the previous day generated. Not platform ROAS. Real profit.

This changed everything.

It gave us the confidence to be aggressive on paid ads while staying calm. No guessing. No panic. Just decisions based on real numbers.

Most e-commerce brands don’t operate this way. They’re flying blind and wondering why margins are thin. Monthly reporting is too slow; by the time you spot a problem, you’ve already lost weeks of margin.

Why Efficiency Is Non-Negotiable in Fashion

Many brands come to us thinking they have a marketing problem when they actually have a cost structure problem. They’re leaving money on the table because they’re simply inefficient.

Here’s the reality of fashion e-commerce: even when things are going well, you’re unlikely to exceed 10-15% EBITDA. Unless you’re operating in true luxury with an exceptionally strong brand, this is a low-margin business.

That means a 2% or 5% leak in your cost structure isn’t a minor issue. It can wipe out your entire profit. With margins this thin, there’s no room for waste. Efficiency isn’t a nice-to-have; it’s survival.

The Results After 9 Months

↳ Net profit margin: from 1% to 12.8%

↳ Contribution margin: 25.4%

↳ MER: 3.95

On nearly €874K in monthly revenue.

The Lesson

Before you push, make sure you’re not pushing inefficiency.

Sometimes growth doesn’t mean spending more. It means fixing what’s broken first.