One mistake we often see at Grapefox when working with fashion brands? Margins, and how they calculate final prices to be truly profitable.

If you sell through your own ecommerce and handle logistics, shipping, and everything else, your gross margins must include the last mile. That means every single cost.

The Margin Illusion

A few days ago, I audited a shoe brand from the U.K. that is mainly selling outside the U.K., in Europe.

When I asked their CMO about margins, she told me:

“We have 65% margins.”

But what does that actually include?

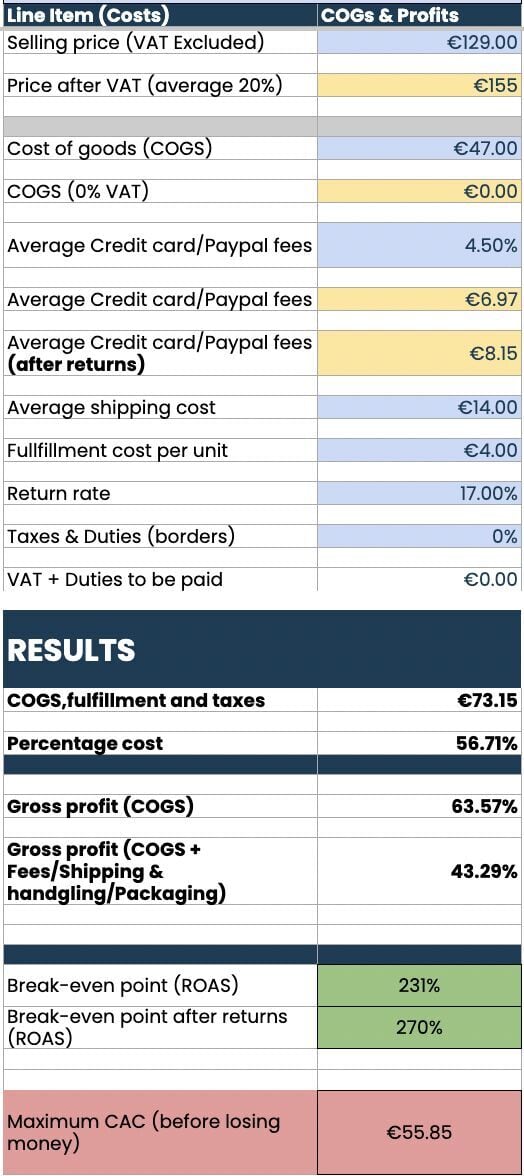

Selling price (VAT excluded) minus COGS? Or selling price minus COGS, shipping, packaging, credit card fees, and returns?

The difference between these two calculations is massive.

According to our data after having worked with more than 100 fashion brands in the last two years alone, established apparel brands typically achieve 40 to 60 percent gross margins after all variable costs; not just COGS, but shipping, packaging, payment processing, and returns (while third-party sellers often land between 25 and 35 percent).

What We Actually Found

Their raw margin (just COGS) was 63.57 percent.

Once we included all relevant costs, it dropped to 44.81 percent.

They did not realise, for example, that international credit card fees on Shopify are approximately 4.5 percent (2.5 percent international plus 2 percent conversion from EUR to GBP).

Almost 5 percent gone on payment processing alone.

Add 17 percent return rates, which impact everything; even the credit card fees. You do not get those fees back when you refund someone.

Final result: around 43 percent gross profit, last mile. Likely less after handling returns.

The Math That Breaks Most Fashion Brands

So what now?

On average, growing fashion brands spend 25 percent of revenue on marketing. We have audited 100+ fashion brands, and most fall between 20 and 30 percent.

Remove that 25 percent from their 43 percent margins and you are left with:

→ 18 percent

With 18 percent, they need to cover fixed costs. For a pure DTC brand, that should be around 10 percent.

This brand was sitting at 25 percent fixed costs; far too much (67,000 pounds per month on 280,000 pounds per month in revenue).

They are losing money.

Why Cash Flow Makes This Worse

Fashion businesses need strong cash flow because of high upfront investments in stock. You are paying for inventory months before customers buy it. When margins are thin, you have no buffer for slow seasons, unexpected returns, or shifts in ad performance.

This is why margin problems compound quickly. A brand operating at 43 percent last-mile margins has almost no room for error. One bad month, one supply chain delay, one spike in return rates; and the business bleeds cash.

The Minimum Margin We Recommend Fashion Brands

→ 55 percent gross margin, last mile

If you hit that, you can confidently scale via paid ads, cover your fixed costs, and grow fast; even during slow months.

Otherwise? No amount of marketing is going to save you.

As you cannot outrun a bad diet, you cannot out-earn bad margins.