Fashion brands are still obsessing over Lifetime Value (LTV).

Here’s why that’s a dangerous mistake.

𝗧𝗵𝗲 𝗲𝗻𝘁𝗶𝗿𝗲 𝗗𝗧𝗖 𝗲𝗿𝗮 𝘄𝗮𝘀 𝗯𝘂𝗶𝗹𝘁 𝗼𝗻 𝗮 𝗳𝗹𝗮𝘄𝗲𝗱 𝗽𝗿𝗲𝗺𝗶𝘀𝗲 𝗳𝗿𝗼𝗺 𝘀𝗼𝗳𝘁𝘄𝗮𝗿𝗲: 𝘁𝗵𝗮𝘁 𝗰𝘂𝗿𝗿𝗲𝗻𝘁 𝗰𝘂𝘀𝘁𝗼𝗺𝗲𝗿 𝗯𝗲𝗵𝗮𝘃𝗶𝗼𝘂𝗿 𝗿𝗲𝗹𝗶𝗮𝗯𝗹𝘆 𝗽𝗿𝗲𝗱𝗶𝗰𝘁𝘀 𝗳𝘂𝘁𝘂𝗿𝗲 𝘀𝗽𝗲𝗻𝗱𝗶𝗻𝗴.

It worked for Netflix. It worked for Salesforce.

It doesn’t work for fashion.

The Flawed Premise: Fashion is Not Software

Here’s the fundamental problem: software has contracts; fashion has transactions.

When a SaaS company calculates LTV, they’re measuring secured future cash flows. When a fashion brand calculates LTV, they’re speculating on future human behavior.

That customer who bought a coat in November? You have no idea if they’ll ever come back. You can’t tell the difference between someone who’s dormant and someone who’s moved on (this is called “unobserved death” in the data).

SaaS companies operate with 80%+ gross margins. Fashion is far more complex; it’s not a piece of software.

Yet brands still use the SaaS benchmark of “3:1 LTV:CAC” based on revenue, not contribution profit. That’s how you burn cash while celebrating “unit economics.”

___

Here’s what people miss: LTV in fashion isn’t a metric that predicts the future.

It’s a snapshot of the past.

Every time you launch a new collection, there’s a real chance it will flop.

Seasons aren’t as stable as they used to be; micro-trends rise and fall within a single quarter.

A customer acquired during a viral trend often exhibits low-affinity behavior.

They’re buying the look, not the brand. Once the trend evaporates, they don’t return. But your LTV model still projects three years of purchases that will never materialize.

___

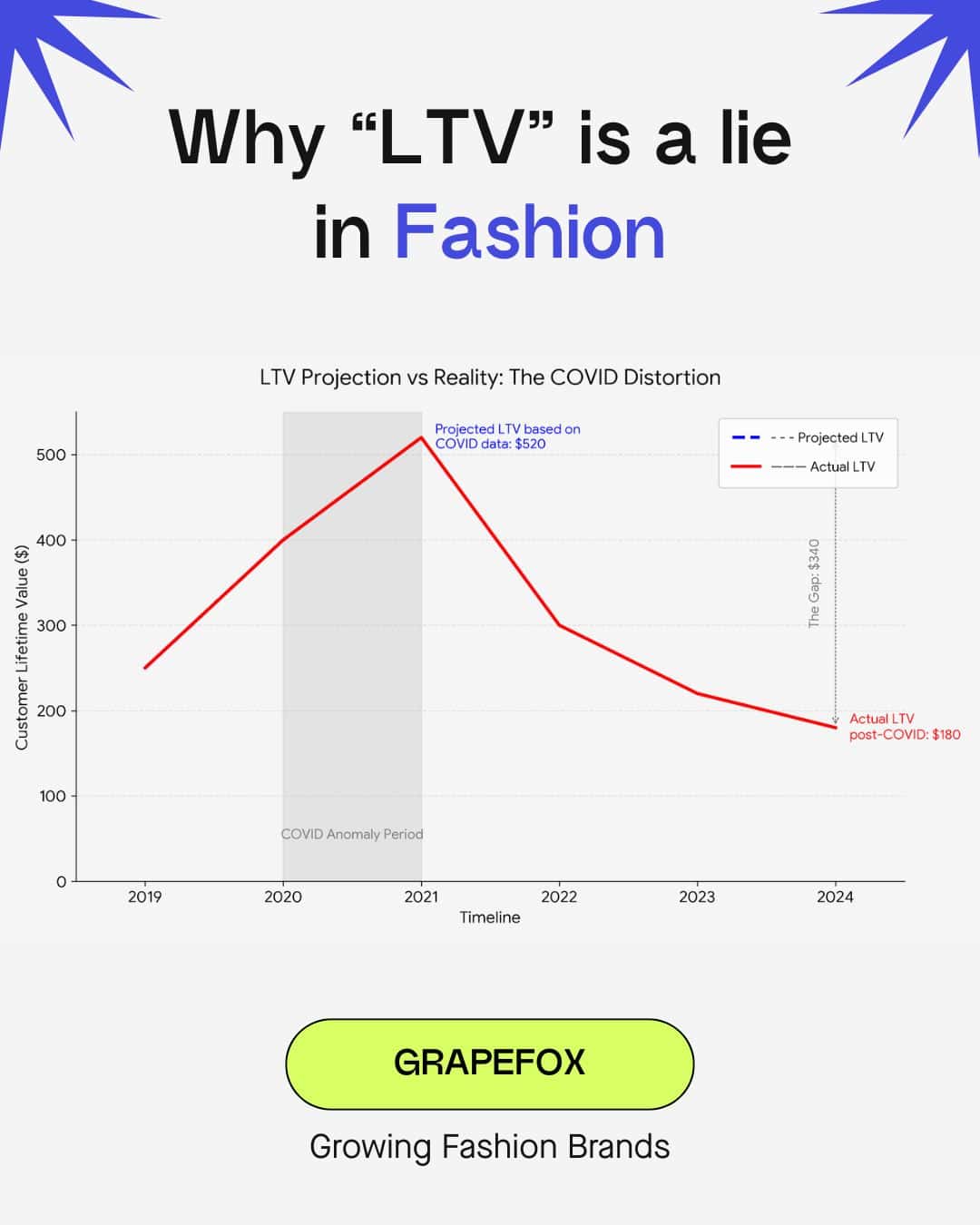

Let’s talk about the “COVID distortion”…

During the pandemic, people bought way more online. Brands looked at 2020-2021 data and mistook temporary behavior for permanent shifts. They projected those retention rates forward into perpetuity and over-leveraged themselves.

When the world reopened in 2022, those customers disappeared. The money never came back.

The case studies prove it:

↳ Allbirds (stock down 90%+)

↳ Farfetch (insolvency)

↳ Stitch Fix (active clients down 20% YoY)

↳ Rent the Runway (asset depreciation killed the subscription model).

___

Why this matters now:

With interest rates at 5%, future cash flows must be heavily discounted. A customer who generates profit in Year 3 is worth far less today than in 2020.

Velocity beats volume.

The metrics that actually matter:

↳ Contribution Margin: Did you make money on this order?

↳ Payback Period: How fast does this customer return their CAC? (target: under 60 days; ideally the same day)

↳ Cash Conversion Cycle: Are you financing growth with debt or cash?

Fashion is not software. It’s a trading business.

Stop building forecasts on data that’s already expired.