This is why you need at least 50-55% margins after all variable costs if you want to grow your fashion brand.

I recently posted that I never suggest going below 50-55% margins after variable costs (CC fees, shipping, packaging). A director of a small brand pushed back in the comments:

“If you need 50-55% margins, you don’t know what you are doing and you are overcharging your clients. Period.”

Here is why he is wrong.

The Data From 100+ Fashion Brand Audits

At Grapefox, I’ve audited over 100 fashion brands in the last two years alone. The data is clear: If you want 10-15% EBITDA and the ability to scale, going below 50% margins (last-mile) will cripple your growth.

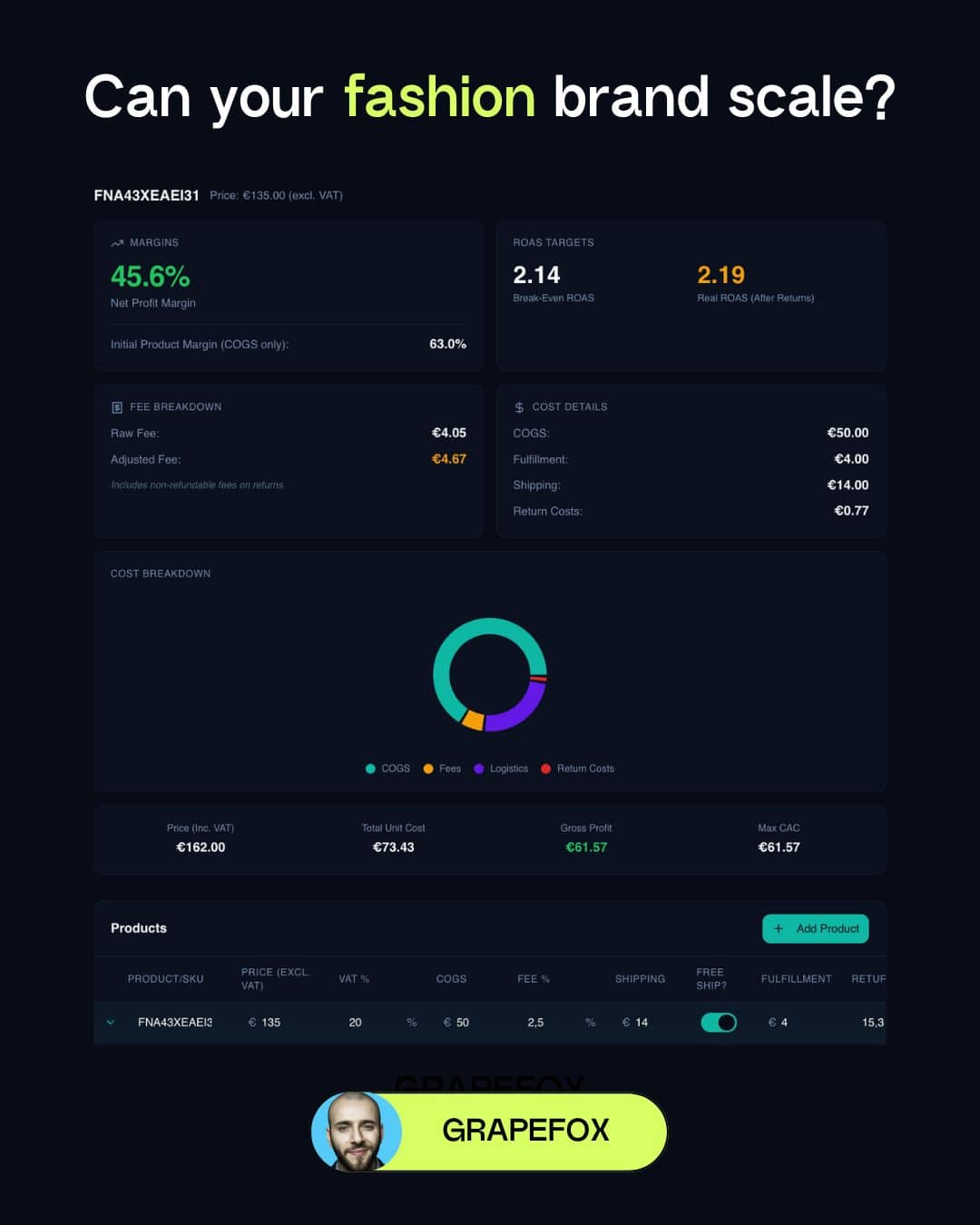

Look at the data in the image below.

This is a real product example. On the surface, the unit economics look amazing:

↳ Price (excl. VAT): €135.00

↳ COGS: €50.00

↳ Initial Margin: 63% (COGS alone)

Most brands stop here. But then reality hits. Look what happens when you subtract the variable costs required to actually get the product to the customer:

↳ Shipping: €14.00

↳ Fulfillment: €4.00

↳ Payment Fees: ~€4.67

↳ Return Costs: (Weighted impact on a single order with a 15.3% return rate) ~€0.77

𝗬𝗼𝘂𝗿 𝗺𝗮𝗿𝗴𝗶𝗻 𝗰𝗿𝗮𝘀𝗵𝗲𝘀 𝗳𝗿𝗼𝗺 𝟲𝟯% 𝗱𝗼𝘄𝗻 𝘁𝗼 𝟰𝟱.𝟲%.

You are left with a Max CAC (Customer Acquisition Cost) of €61.57.

“But I can just grow organically, right?”

Sure. You can grow organically. You can build a nice, slow-burning lifestyle business relying solely on word of mouth.

But the magic happens when you push the pedal to the metal 🙂

Real scale comes from aggressive PR, marketing, and paid advertising. If you want to accelerate, you need to feed the machine. And that is where the trap is.

You Cannot Creative Your Way Out of Platform Costs

You cannot “creative” your way out of the cost of doing business.

There is a myth that if your ads are good enough, your traffic costs will drop by a lot. They won’t.

↳ Google’s “Invisible Floor” (Ad Rank Threshold): You pay a reserve price based on user value. You cannot bid $0.05 and win, regardless of competition.

↳ Meta’s “Premium Tax”: High-intent buyers cost a premium CPM. This creates a mathematical floor for your Cost Per Click that no creative can bypass.

Do the math: If the “Platform Floor” dictates that a conversion costs €40 – €50 in your market, and you only have €61.57 left… you have barely €10 of profit.

One bad week, one extra return, or a slight rise in CPMs, and you are underwater.

That is why 45% is dangerous, and 55% minimum is a moat.

High margins aren’t about “overcharging.” They are about building a defensive buffer that allows you to:

↳ Absorb the unavoidable price floors of paid platforms.

↳ Outbid competitors stuck with thinner margins.

↳ Actually walk away with profit after the algorithm takes its cut.

If you don’t have the margin, you won’t have an easy time in this industry.