Miu Miu just posted the most impressive financial scorecard of the year.

While the rest of the luxury industry slowed down in 2024, Miu Miu nearly doubled in size. This is not a minor outperformance; it is a complete departure from what every other major house experienced.

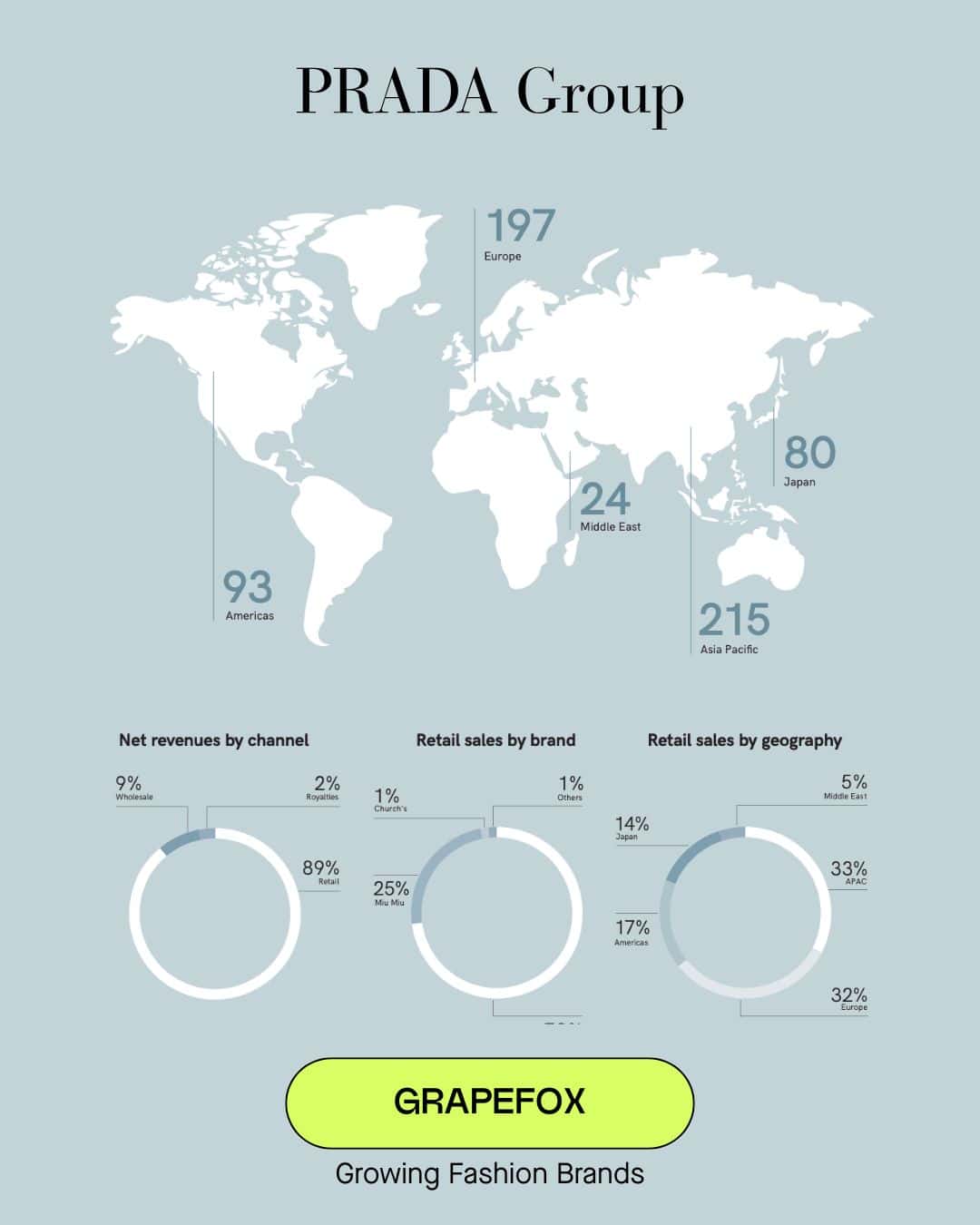

The Prada Group’s latest report reveals a “two-speed” performance that is fascinating to watch. When you look at the numbers side-by-side, you see two completely different stories happening under the same roof.

The Industry Context

To understand how remarkable Miu Miu’s performance is, consider what happened to its competitors. Gucci saw revenues fall 20% in the first half of the year. Burberry’s retail sales plummeted 22%. Even LVMH missed analyst expectations for the second quarter.

Across the board, major houses struggled with slowing demand in China, cautious spending in the Americas, and what many called “post-pandemic spending fatigue.” In this environment, double-digit declines became the norm, not the exception.

Then there was Miu Miu.

The 2024 Financial Breakdown

Prada:

→ Revenue: Steady, mature growth.

→ Retail Growth: +4%

→ Role: It provides the stability and pays the bills.

Miu Miu:

→ Revenue: Explosive acceleration.

→ Retail Growth: +93%

→ Role: It drives the hype and the new profit.

To put that +93% in perspective, Miu Miu generated approximately €1.23 billion in sales this year. The brand achieved annual sales exceeding €1 billion for the first time in its history. For context, the Lyst Index ranked Miu Miu as the hottest brand in the world for Q4 2024.

Why Retail Control Matters

Most brands try to grow by selling their products everywhere, often relying on wholesale partners to move volume. Miu Miu did the opposite.

They generated that €1.23 billion while keeping 90% of their business in their own retail stores. By limiting wholesale to less than 10%, they controlled the entire economic cycle. This approach does several important things at once.

→ Price Control: They sold almost everything at full price, without department store markdowns.

→ Regional Demand: This strategy worked globally, but especially in Japan, where sales jumped +46%.

→ Profit Impact: Because they didn’t share margins with retailers, Miu Miu’s efficiency helped lift the entire Group’s EBIT margin to 23.6%.

When a brand sells through department stores, it loses pricing power. The retailer can discount, run promotions, and place products next to competitors. Miu Miu avoided all of that by betting on its own stores.

The Balanced Portfolio Advantage

The Prada Group has managed to build the most balanced portfolio in the industry right now. They have Prada for consistency and heritage. They have Miu Miu for velocity and hype.

This structure creates a hedge. When the market slows (as it did in 2024), Miu Miu’s explosive growth offsets any softness in Prada’s more stable numbers. When hype eventually cools, Prada’s steady performance keeps the foundation secure.

It proves that you don’t need to choose between stability and high growth. If you manage your brands correctly, you can have both.