In 1974, the physicist Richard Feynman gave a graduation speech at Caltech about something he called “Cargo Cult Science.”

During World War II, American forces set up bases on remote islands in the South Pacific. The indigenous tribes watched in amazement as planes landed carrying food, medicine, clothing, technology. Unimaginable wealth falling from the sky.

When the war ended and the soldiers left, the tribes wanted the cargo to return. So they did what seemed logical: they imitated everything they had seen. They built runways in the jungle. They lit fires along the sides. They constructed control towers from wood and bamboo. They carved headphones from coconuts and sat in the towers, “directing” air traffic.

The form was perfect. It looked exactly like before.

But the planes never came.

They were missing something essential. They had copied the rituals without understanding what actually made the planes land.

I think about this story often when I work as an advisor alongside fashion founders.

In 2022, I met one who had built what looked like the perfect brand.

Beautiful product. Strong margins. Loyal customers. A Instagram following that made competitors jealous. Revenue had grown every year for four years. He was doing everything right.

Then growth stopped.

Not declined. Stopped. Like hitting an invisible wall. He spent the next eighteen months trying to break through. New agencies. New creatives. New platforms. New strategies. Nothing worked. Revenue stayed flat while his competitors pulled ahead.

When we finally spoke, he asked me the question I’ve heard from hundreds of founders since: “What am I doing wrong?”

The answer was: nothing. And everything.

He wasn’t doing anything wrong with his marketing. His ads were fine. His content was fine. His website was fine. The problem was that none of those things were the problem.

His manufacturer could only produce a few hundred units per week. His cash flow couldn’t support the inventory he’d need to grow. His entire business was built on a single acquisition channel (Meta Ads).

He was pushing against walls that pushing couldn’t break.

This is the story of almost every fashion brand that gets stuck. And most of them get stuck.

The Ceiling Game

Let me tell you how growth actually works in fashion.

It doesn’t look like a line going up. It doesn’t look like a hockey stick. It looks like a staircase with locked doors.

You climb. You hit a ceiling. You stop. You figure out how to break through. You climb again. You hit another ceiling. This repeats until you either break through to real scale or you give up.

I call it The Ceiling Game.

This isn’t how all businesses work. A software company grows differently. A service business grows differently. But if you sell physical products online, especially in fashion, this is your reality. The sooner you accept it, the sooner you can learn to play.

Every stage has its own ceiling.

At €0-500K, the ceiling is product-market fit. Do people actually want what you’re selling? Can you get anyone to buy it?

At €500K-2M, the ceiling becomes cash flow and margins. You’re selling, but you’re not keeping enough to reinvest. You’re profitable on paper and broke in practice. The business grows while you run on a treadmill.

At €2M-5M, production and supply chain become the ceiling. Your manufacturer can’t keep up. You’re selling faster than you can replenish. Stock-outs kill your momentum.

At €5M+, the ceiling is structure itself. You need wholesale. You need organic presence. You need systems that don’t depend on you doing everything.

Only about 1-2% of fashion brands ever break past €5M in online revenue.

Not because they lack talent. Not because they lack good products. Because they never figure out which ceiling they’re hitting, and they keep using the wrong tools to break through.

Chasing Shadows

Here’s what I see happen, again and again.

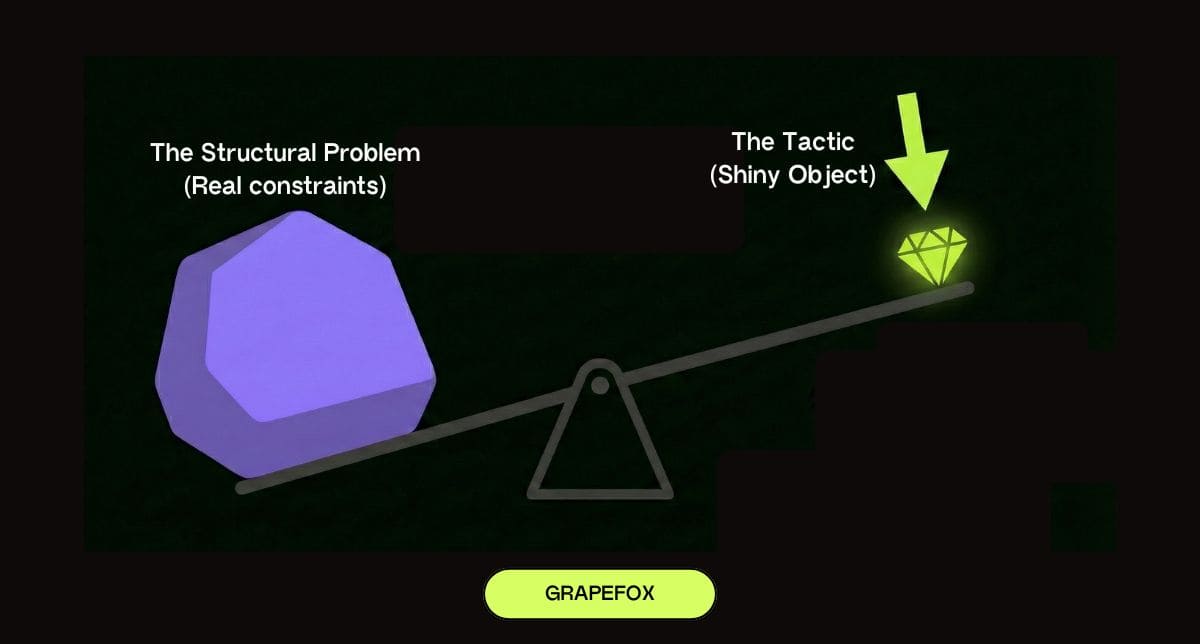

A founder hits a ceiling. Revenue flattens. Growth stalls. And their response is always the same: chase the shiny object.

New agency. New creatives. AI-generated UGC. Automated TikTok videos. The latest email marketing hack. Whatever LinkedIn is buzzing about this week.

It feels productive. There are dashboards. There are numbers. There are levers to pull. You can see what’s happening. You can measure it. You can tell yourself you’re doing something.

I see it constantly. Founders come to me hoping I’ll give them a tactic. A trick. Something clever they can implement next week. And when we dig into the real problems (cash flow, margins, product-market fit, production capacity) I watch their eyes glaze over. They don’t want to hear it. They want the shiny object.

“But what if we used AI for our creatives?”

“What about automated video content?”

“Should we be doing more with email flows?”

Meanwhile, the real ceiling has nothing to do with any of that.

It’s your 45% gross margin that can’t support profitable customer acquisition. It’s your manufacturer who needs six weeks to deliver what you could sell in three days. It’s your cash flow that’s so tight you can’t buy inventory for next season. It’s your entire business concentrated on a single channel that could change its algorithm tomorrow.

But those problems are hard. They require difficult conversations. They might mean admitting your pricing is wrong, your suppliers are wrong, your whole model needs rethinking.

Shiny objects are easier. They feel controllable. They’re what everyone else is talking about.

And here’s something that makes it worse: the people selling these services have every incentive to reinforce the lie.

Think about it. An agency wants to sell you marketing services. You come to them convinced your problem is marketing. Are they going to tell you “actually, your margins are broken and no amount of ads will fix that”? Of course not. They’re going to nod, agree that your marketing needs work, and sell you exactly what you wanted to buy.

It’s much easier to sell someone a solution to the problem they think they have than to tell them the truth they don’t want to hear.

I’ve lost deals because I told founders the truth. They came to me hoping I’d validate their belief that better marketing would fix everything. When I pointed to their cash flow, their margins, their production bottlenecks, they didn’t want to hear it. They went to someone else who told them what they wanted to believe.

So founders keep chasing shiny objects while the real constraints stay untouched. They convince themselves the next tactic will fix it. The next tool. The next hack. And there’s an entire industry happy to take their money and agree with them.

This is what chasing shadows looks like in fashion.

Here’s the paradox: the breakthroughs that actually work are almost always counterintuitive.

They’re counterintuitive because nobody talks about them. They’re not on LinkedIn. They’re not in the marketing podcasts. They don’t make for sexy case studies.

Moving your production to China isn’t exciting. Renegotiating payment terms with suppliers isn’t exciting. Shutting down your in-house fulfillment to use a 3PL isn’t exciting. Cutting your team in half to fix your cost structure isn’t exciting.

But these are the moves that break ceilings.

The reason founders don’t think of them is simple: if they had thought of them, they would have already done them. The real constraints are invisible precisely because they’re uncomfortable to see.

Let me be direct: you cannot hack your way out of a structural problem.

If your margins can’t support growth, better tactics won’t save you. If your production can’t scale, more traffic will only create more stockouts. If your cash flow is broken, spending more will only break it faster.

The founders who stay stuck are the ones who keep looking for clever solutions to structural problems.

The founders who break through are the ones who stop, look honestly at what’s actually constraining them, and fix that instead.

Fashion Is Not About Fashion

Here’s something that might change how you think about your brand.

The core of your business is almost never what you think it is.

You think you’re in the business of selling clothes. You’re probably not.

Look at Shein. On the surface, it’s a fashion company. But Shein isn’t in the fashion business. Shein is a logistics and production machine that happens to sell clothes.

They produce 2,000 to 10,000 new styles per day. They go from design to product in under two weeks. They start with micro-batches of 100 units, test demand in real-time, and only scale what sells. Their supply chain is so integrated they’ve turned manufacturing into software.

Shein doesn’t win because of marketing. They win because they’ve built one of the most agile production operations on the planet.

Amazon is the same. People call it a retailer. It’s not. Amazon is a logistics company that also sells things. The retail operation exists to feed the infrastructure. When they realized their fulfillment network was a competitive advantage, they turned it into a product and sold it to everyone else.

McDonald’s is perhaps the clearest example. Former CFO Harry Sonneborn said it plainly: “We are not technically in the food business. We are in the real estate business. The only reason we sell fifteen-cent hamburgers is because they are the greatest producer of revenue from which our tenants can pay us our rent.”

McDonald’s owns the land under its restaurants. They collect rent from franchisees. The burgers are just the mechanism that makes the real estate valuable.

The pattern repeats across industries: the real business is always somewhere else.

In fashion, the real business is rarely just design. It’s distribution. It’s operations. It’s marketing. It’s the ability to get products made, moved, and sold efficiently at scale.

If you can’t produce fast enough, cheap enough, reliably enough, nothing else matters. Your brand doesn’t matter. Your aesthetic doesn’t matter. Your Instagram doesn’t matter.

The brands that break through are the ones who figure out where their real business is. Then they get extremely good at that thing.

Light Model, Heavy Mistakes

Selling online has a fundamental advantage that most fashion brands completely waste: you can build a business with almost no fixed costs.

No factories. No warehouses. No retail stores. You can use 3PLs for fulfillment, contract manufacturers for production, platforms for your storefront. You can integrate with third parties for almost everything.

This means you can start lean, scale fast, and spread risk across partners instead of concentrating it in assets you own. It’s one of the most capital-efficient business models that exists.

Here’s the paradox: most fashion brands do the opposite.

They take on all the disadvantages of the model (thin margins, cash flow pressure, dependency on partners) without capturing any of the advantages (low fixed costs, flexibility, speed).

I’ve seen brands sign expensive retail leases while still figuring out product-market fit. Founders who hire ten people when three would do. Companies that bring fulfillment in-house at enormous cost when a 3PL would do it better and cheaper.

They load up on fixed costs in a model that punishes fixed costs mercilessly.

Fashion is hard. Even when everything goes well, you’re looking at 10-15% EBITDA at best. You need at least 55% gross margin after all variable costs just to have room to operate. Cash flow is brutal because you buy inventory before you sell it.

The brands that win stay lean. Stay flexible. Only add fixed costs when there’s clear evidence it will pay off.

And they build redundancy into everything.

The Single Point of Failure

The lean model has a hidden trap.

The whole advantage of modern fashion is that you can integrate with others. No factories, no warehouses, no retail stores. You plug into 3PLs, manufacturers, platforms, payment processors, wholesalers. You stay light. You stay flexible.

But every integration is also a dependency. And every dependency is a potential single point of failure.

I’ve seen it happen too many times.

A brand uses one bank. Something triggers a compliance review. The account freezes. Suddenly they can’t pay suppliers or make payroll.

A 3PL has operational issues. Shipments stop. Customers complain. Refund requests pile up. There’s nothing to do but wait.

A manufacturer has a problem (fire, equipment failure, labor dispute) and the entire production pipeline stops. Orders coming in, nothing to ship.

Or the whole acquisition strategy depends on one channel. That channel changes its algorithm. Costs jump 40% over a couple of months. Unit economics collapse. And building alternative channels takes months or years. You pay the price immediately and enter a spiral of devastation with no quick way out.

One point of failure. One thing goes wrong. The whole business falls.

The solution is redundancy.

Two banks minimum. Backup manufacturers, even if you only use them for small volumes. Multiple fulfillment options. Diversified acquisition channels.

This feels inefficient. Extra relationships to maintain. Higher costs to split production. More complexity to manage.

But the alternative is a business where one phone call can shut everything down.

Build systems with backups. Build relationships you don’t fully use yet. Build alternatives before you need them.

Redundancy isn’t waste. It’s insurance. In a business built on integration, it’s not optional.

What Breaking Through Looks Like

Let me give you three real examples.

A brand stuck at €15M. Good margins, product selling well, but growth had stalled. Their European manufacturer was slow, expensive, couldn’t handle larger volumes. A few thousand units per week, and even that was a struggle.

We advised them to move production to China.

Costs dropped 40%, even after air freight and customs. The European factory did hundreds per week. The Chinese factory could do tens of thousands per day. Lead times went from weeks to days. Quality stayed the same or improved because the equipment was better.

Within twelve months: €15M to €20M. EBITDA grew by 4 percentage points. Not just more volume. More profit. Same product. Same brand. Same marketing. Different ceiling broken.

Another brand bleeding cash despite decent revenue. They’d built in-house fulfillment with a large team, expensive warehouse, all the overhead. They thought owning logistics would be an advantage.

It was strangling them. Fixed costs so high there was no flexibility. Every missed target put them deeper in the hole.

We advised them to shut it down and move to a 3PL. Fixed costs became variable. Headcount dropped. Suddenly there was breathing room to actually invest in growth.

A DTC brand that had plateaued. Everything optimized, acquisition costs rising, growth stalled.

The breakthrough wasn’t doing more of the same. It was wholesale.

They started selling through retailers, online and physical. New revenue stream (no acquisition cost), plus a halo effect on the direct business. More people saw the brand in stores, searched for it online, organic traffic grew.

Wholesale added millions in revenue and made every other channel work better.

Three brands. Three different ceilings. Three different breakthroughs. None of them were marketing problems.

The Planes Don’t Land

The founder I mentioned at the beginning, the one with the perfect brand that stopped growing, he eventually broke through.

Not by finding better ads. Not by hiring a better agency. Not by cracking some algorithm.

He rebuilt his supply chain. Renegotiated with manufacturers. Fixed his cash flow. Diversified his channels. Did the hard, unglamorous work that doesn’t show up on a dashboard.

It took two years. It wasn’t fun. But it worked.

Most fashion brands will never break €5M. Not because they lack creativity or passion. Because they keep building runways in the jungle, lighting fires along the sides, carving coconut headphones. They copy the rituals of successful brands without understanding what actually makes the planes land.

The Ceiling Game isn’t fair. Every time you break through, there’s another ceiling waiting. The tools that worked last time won’t work next time. You have to keep adapting, keep finding new breakthroughs, keep being honest about what’s actually holding you back.

But that’s how fashion brands actually grow.

Stop performing the rituals. Stop copying the form. Figure out what actually makes the planes land.

Then build that.