Many fashion brand founders face the same dilemma: they’ve built something with quality materials, real craftsmanship, and production costs that reflect it. But they price it like fast fashion because they’re afraid of losing customers.

This is a mistake. And the economics prove it.

Your cost structure determines your market position. Not your ambition, not your branding, not your Instagram aesthetic. If your fashion brand has premium costs, you need premium pricing. Otherwise, you’re playing a game you cannot win.

And if you can’t sell at the right price with healthy margins? That means you don’t have product-market fit. You either change what you’re making, update your approach, or close. There’s no way around it.

The Numbers Don’t Lie

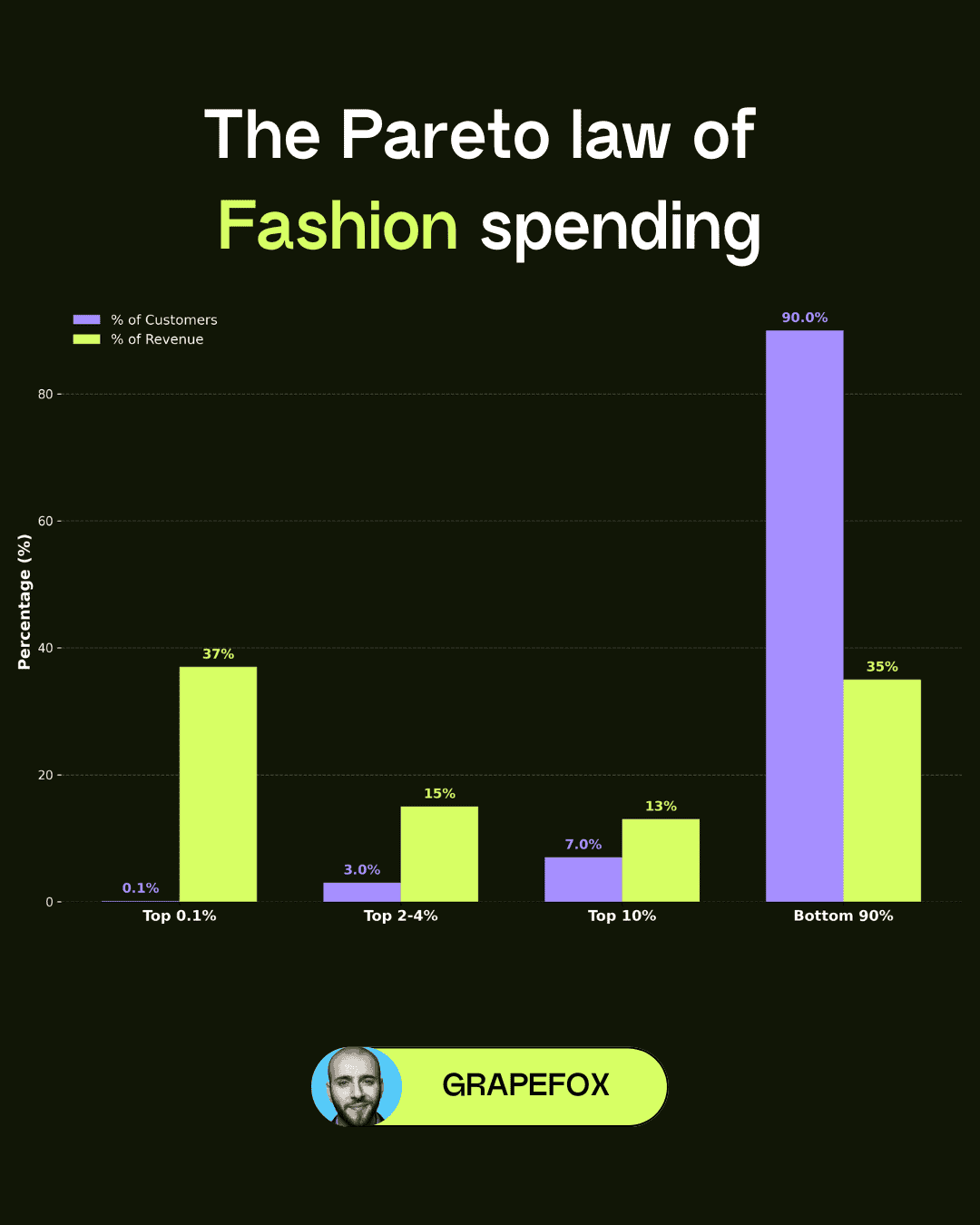

The top 10% of consumers in fashion drive between 35% and 50% of all spending. This isn’t a fashion stat. It’s a universal economic law (Moody’s Analytics, 2025).

Some economists argue the real number is closer to 35%, others say 50%. Either way, the pattern is clear.

And in luxury, it’s even more extreme. According to BCG and Altagamma, the top 0.1% of luxury clients generate 37% of the entire market value. Less than 1% of customers drive over a third of revenues.

Recent McKinsey data makes this even more striking: ultra-high net worth clients comprise between 2% and 4% of luxury’s client base but account for 30% to 40% of the sector’s spend. These same customers will create 65% to 80% of global market growth through 2027.

If you’re building a brand with quality production, good materials, or any structural cost that isn’t rock-bottom, you cannot compete in the mass market.

The Mass Market Plays One Game

The mass market competes on one variable only: price.

If your costs don’t allow you to win on price, you’re not playing the game. You’re losing it.

I see this constantly: fashion brands with premium costs but mass-market pricing and strategies.

“If we raise prices, we’ll lose customers” founders tell me when I point out their margins are too low.

Yes. You’ll lose the wrong customers.

The Wrong Customer Problem

The mass-market customer pays less but expects more. They compare you to Zara. They return more. They complain more. They drain your margins and your energy.

Here’s the paradox: return rates in fast fashion are significantly higher than in luxury. Our data confirms this; after working with hundreds of fashion brands, we consistently see fast fashion return rates between 25% and 35%, while premium and luxury brands sit closer to 15% to 20%. The customer paying €50 has higher expectations than the one paying €500.

Why? Luxury buyers are more deliberate. They research before purchasing. Higher price tags discourage impulsive buying and the “bracketing” behavior (ordering multiple sizes with intent to return) that plagues mass-market fashion retailers.

There’s also a psychological element at play. When someone spends €500 on a piece, they’ve already committed mentally. They want it to work. They’ll style it differently, give it a second chance, find occasions to wear it. The €50 buyer hasn’t made that commitment. If it doesn’t fit perfectly out of the box, back it goes.

This means your customer service costs go up, your logistics costs go up, and your inventory management becomes a nightmare. All while your margins stay razor-thin.

Your Only Option

If your production costs put you outside the price-competition game, your only option is to move up. Not because it’s a “nice strategy.” Because it’s an economic law.

You don’t choose your market position based on fear. You choose it based on your cost structure.

If your numbers don’t work, you have three options:

- Raise prices

- Cut production costs

- Close

There’s no fourth option.

Staying in the middle is like stopping halfway across a busy intersection. You will get hit.

Know Who Wins at the Bottom

You can price for the 90% if you understand the rules of that game. It’s a legitimate choice. But you need to be honest about what it requires.

Look at who wins there: Shein.

Rock-bottom costs, no labor protections, zero regard for regulations. They operate at a scale and cost structure that most fashion brands cannot replicate. You’re not competing with them. You can’t.

They know exactly what they’re doing. Shein doesn’t try to play premium or luxury fashion. They understood their game and they stay in their lane. Their entire business model is built around speed, volume, and disposability. Every decision they make optimizes for price.

If you want to compete in the mass market, you need to make similar choices. That means cheaper materials, offshore production with minimal oversight, and accepting that your product will be compared to whatever costs €15 on Temu.

For most fashion brands with any commitment to quality or ethics, this isn’t a viable path.

The same logic applies to your fashion brand; just in reverse. If you’ve chosen better materials, fair wages, and careful production, you’ve already made your decision. Now your pricing needs to reflect it.

Know where you stand. Then price accordingly.