Levi’s just revealed what every fashion brand chasing DTC dreams needs to hear: wholesale still drives 54% of their $6.4 billion business.

While CEO Michelle Gass celebrates her “DTC First” strategy delivering 11% growth, here’s what the numbers actually show: wholesale dropped 3.4% and still generates more revenue than DTC.

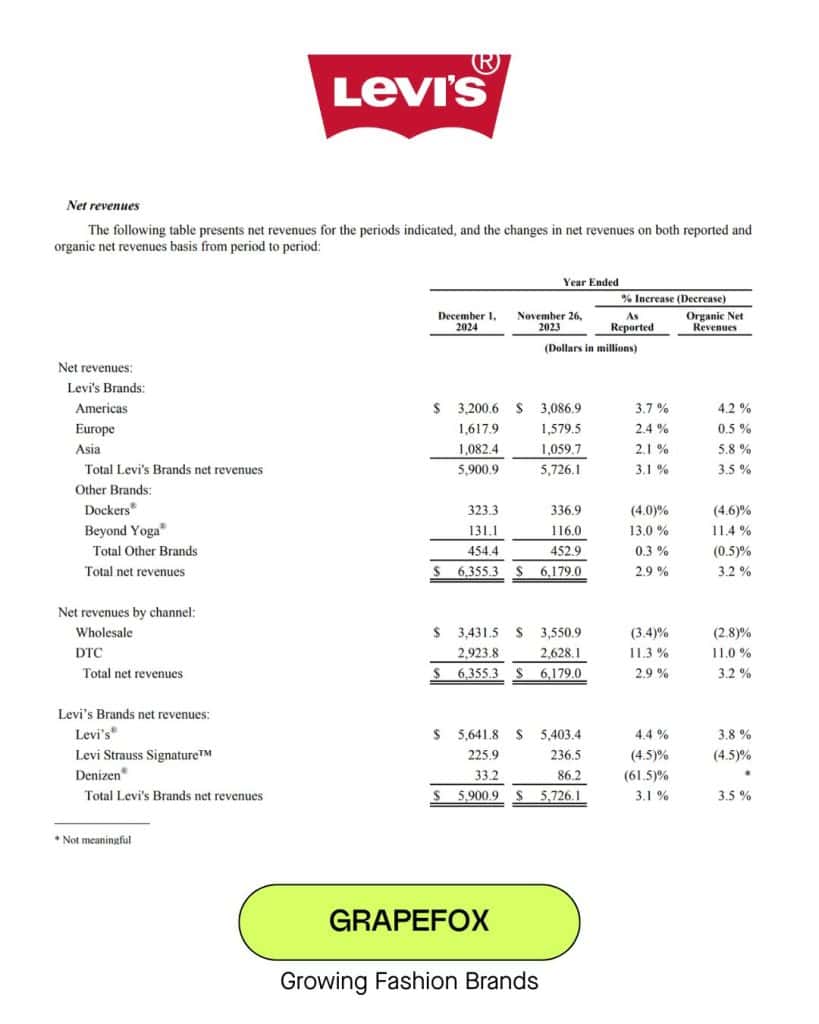

The 2024 Revenue Breakdown

The 2024 breakdown:

↳ Wholesale: $3.4 billion (54% of revenues, down 3.4%)

↳ DTC: $2.9 billion (46% of revenues, up 11.3%)

↳ Added 157 company-operated stores in one year

Despite aggressive DTC expansion and double-digit growth, wholesale still generates $500 million more in annual revenue.

The DTC-First paradox

Levi’s is pouring resources into DTC infrastructure:

↳ High fixed costs in retail real estate

↳ Significant ongoing investments in equipment, inventory, and personnel

↳ IT systems and omni-channel capabilities

↳ Rising labor costs at distribution centers

Meanwhile, their wholesale channel declined 3.4% in 2024 (a warning signal they couldn’t ignore). By Q4, management shifted focus to “stabilizing wholesale” for 2025.

Translation: they realized the DTC-only path has limits.

Why Wholesale Still Matters In Fashion

Why wholesale still matters

Levi’s sells through approximately 50,000 retail locations worldwide. Their products sit in department stores, specialty retailers, and mass channels where consumers already shop.

That’s reach DTC can’t replicate (at least not profitably).

The math is simple:

↳ DTC: Higher margins × limited reach × high fixed costs = growth ceiling

↳ Wholesale: Lower margins × massive distribution × lower fixed costs = sustainable scale

The real strategy

Levi’s isn’t choosing between channels (they’re optimizing both):

↳ DTC gives them brand control and customer data

↳ Wholesale gives them market penetration and volume

↳ The combination creates brand omnipresence

Their top 10 wholesale customers still represent 26% of total revenues. No amount of DTC growth can replace that overnight.

The lesson for fashion brands

Stop viewing wholesale as legacy distribution. It’s a growth multiplier when executed strategically.

The winning formula isn’t DTC-first or wholesale-first. It’s channel harmony.

Nike already tried going all-in on DTC but backtracked because it didn’t make sense in the long run, financially speaking. Now Levi’s is pushing “DTC First” while quietly working to stabilize their wholesale decline.

It will be interesting to see how fashion brands decide to play in the future and what distribution channels they choose to prioritize.

The winners won’t be the brands that choose one channel over the other. They’ll be the ones that master both.